Production growth continues

Greater self-sufficiency is the result

- Production: US hits an all-time high

- Demand: The US continues to lead in demand, which is rising

North American production hits a record high

self-sufficiency

Thanks to the continuing growth of North American oil production, the region’s annual import bill has gone down by USD 130 billion in just a decade.

In 2017, North America produced 20.1 million barrels of oil per day – a 48% increase versus output in 2007.

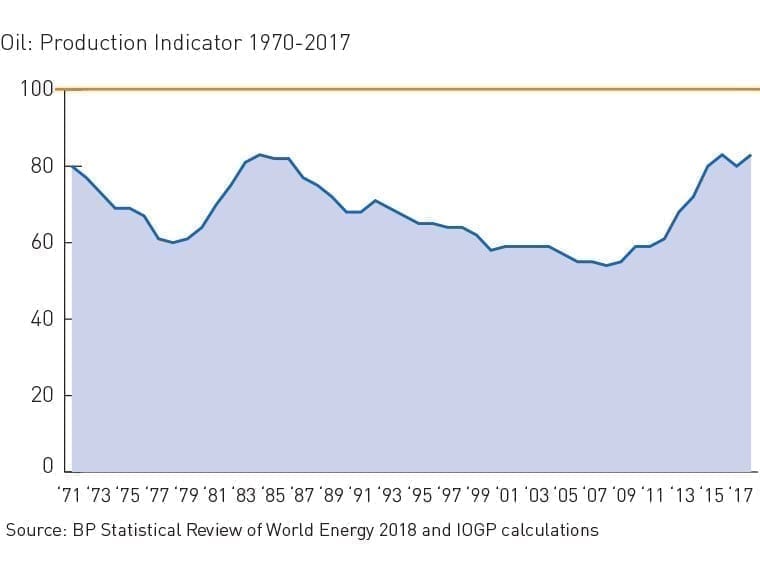

The US has enjoyed the lion’s share of that increase. Its production has gone up by 90% in a decade. Its Production Indicator also shows a dramatic improvement, having gone from 33% in 2007 to 66% in just 10 years.

Canada has also benefited from a significant production increase, with a 47% rise during the course of a decade. As a result, its Production Indicator is 199% versus 141% previously.

Within the region, only Mexico has seen a drop in production to a 25-year low. While it once equaled Canada in its output, Mexico now produces only half of Canada’s volume. The nation still remains an oil exporter, but with a Production Indicator of 116%, its position is considerably weaker than 10 years ago, when the Mexican Production Indicator was 167%.

Consuming every forth barrel the world produces

North America is the world’s second largest consumer of oil, accounting for 25% of demand in 2017. This level of consumption has been fairly steady for the past 15 years, with upward trends in the two largest regional consumers, the US and Canada.

The US share of regional demand is 82% equivalent to 19.9 million barrels per day. Canada accounts for 10% of regional oil use at 2.4 million barrels per day – an all-time high. Its oil use is equivalent to that of Germany, despite having a population less than half the size.

Mexico’s demand is 1.9 million barrels of oil per day, or 8% of regional consumption.

What remains and where

North America holds 13% of the world’s proven oil reserves.

Most of those reserves are in Canada, with a 75% regional share. The US follows with 22%. Mexico holds 3% of the region’s reserves.

Future of oil in North America: a remarkable transformation

North American oil supply is in the midst of a remarkable transformation. A decade of significant growth, fuelled by unconventional resources such as shale and tight oil, has brought major economic benefits to the region and put the United States on the path to being a net exporter of oil for the first time in decades.

ExxonMobil is proud to be part of this story. Our major, ongoing investment in the Permian basin in West Texas and New Mexico is a great example. Subsidiary XTO Energy has announced plans to triple its daily production from the area to more than 600,000 oil-equivalent barrels by 2025. Tight oil production from the Delaware and Midland portions of the basin will increase five-fold in the same period.

As part of this ambitious expansion plan, we will be investing more than $2bn in terminal and transport infrastructure to help get the increased supplies to where they are needed. This includes our Gulf Coast refineries and chemical facilities that manufacture high-value products, such as polyethylene for high performance plastics and advanced synthetic lubricant base stocks.

Technology is key to these ambitious plans. Technology improvements have helped double our footage drilled per day on horizontal wells in the Permian since early 2014, and reduced our per-foot drilling costs by about 70%. At the same time, XTO Energy has cut methane emissions from its operations by 9% since 2016 as result of a major mitigation programme that includes deployment of low-emission design technologies across its facilities.

Staale Gjervik, Senior Vice President, Permian Integrated Development, XTO Energy Inc.