North America produces more gas than ever before

Growth in US volumes predominates

- Production: US production continues to grow in terms of volume and share

- Demand: The US continues to dominate the region in terms of gas demand

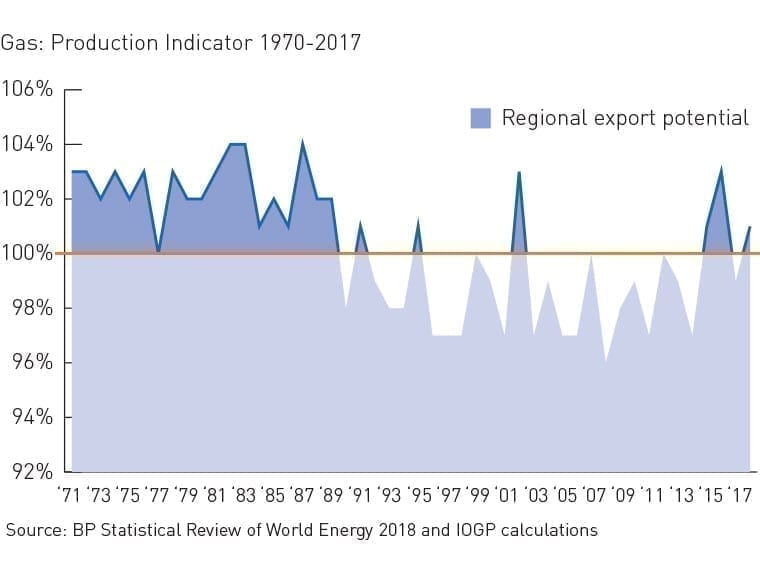

North America’s gas production exceeds its gas needs. In 2017, the region produced more than 950 billion cubic metres of gas – a record output. Compared with 2007, this was an increase of 210 billion cubic metres (or 28%) – equivalent to more than the combined gas output of Norway, the Netherlands and the UK.

The growth in North American gas production is entirely attributable to the US. It was the region’s biggest producer by far, with a regional share of 77%. US output boosted its Production Indicator to 99%. Various projects are underway to establish the US as a major exporter of Liquefied Natural Gas (LNG).

Canada is North America’s second-largest gas producer. In 2017 its regional share was 19% based on production of 176 billion cubic metres – identical to Canada’s gas output a decade ago, but considerably more than the 150 billion cubic metres produced in the period from 2010-2013. The country’s 2017 Production Indicator was 152%.

Mexico trailed in 2017 with 4% of the region’s gas output. Its production of 41 billion cubic metres during the year was its lowest level since 2004. Its 2017 Production Indicator of 46% is just over half of what it was in 2007.

Demand just short of last year’s record high

In 2017, North America’s gas demand was 943 billion cubic metres, just under 1% less than the previous year.

More than three quarters of that demand – 79% – came from the US.

Canada’s record appetite for 116 billion cubic metre of gas during the year accounted for 12% of regional demand.

As with gas production, Mexico’s level of demand put it third in the region, using 9%.

What remains and where

North America holds 5.6% of the world’s proven gas reserves.

More than 80% of those reserves are to be found in the US. Canada holds 17% of the regional reserves.

US natural gas production just powered past the impossible

The US natural gas industry has quietly achieved a huge milestone over the past year: unprecedented production growth of more than 9 billion cubic feet per day (bcf/d) – a 12 percent increase compared to 2017.

What’s changed in the last year? Broad technological advances in well completion techniques and performance across multiple levels of the US exploration and production sector. Through the use of big data tools, honed drill targeting, and drilling of longer laterals, the industry has eclipsed all production expectations – reducing its environmental footprint in the process. Breakeven costs to drill a dedicated natural gas well in major producing basins fell below $2.00 per million BTU (mmBtu), and natural gas prices at Henry Hub remained below $3.00 per mmBTU as they have on average for nearly four years. The trends suggest this year’s production growth could be repeatable for years or decades to come if policy headwinds don’t interfere.

At the moment, the forecast is concerning. US natural gas abundance creates the challenge to identify additional markets, at home and abroad. Domestically, the proposed bailouts for uneconomic coal and nuclear power plants could impair natural gas’ ability to compete in US electricity generation. Internationally, China’s imposition of import tariffs on US LNG make it hard to compete there.

The bottom line is that the US natural gas industry has achieved remarkable milestones but needs a level playing field that could make the difference between seizing, or squandering, this historic US natural gas opportunity and harnessing the numerous benefits of our nation’s vast resources.

Dean Foreman, Chief Economist, American Petroleum Institute