More imports than ever

Asia Pacific produces little more than a fifth of the oil it needs to meet its growing requirements

- Production: A slight decline consistent with recent history

- Demand: China’s oil demand more than doubled since 2003

A population powerhouse with increasing oil demand

elsewhere for more than three quarters of the oil

it needs for continued growth and prosperity.

Well over half of the world’s population lives in Asia Pacific. But the region accounts for only 8% of global oil production.

Current production of 7.9 million barrels per day is roughly equivalent to the region’s output of a decade ago and slightly below the regional average of the past 20 years. It is 5% below the peak production reached in 2015.

Within Asia Pacific, both China and Thailand have increased their flows of oil since 2007. Australia’s production has dropped during that period.

China is Asia Pacific’s largest oil producer by far. Its output of 3.8 million barrels per day gave it a 49% share of the region’s total. The other biggest producers were Indonesia with a 12% share, India with 11% and Malaysia with 9%.

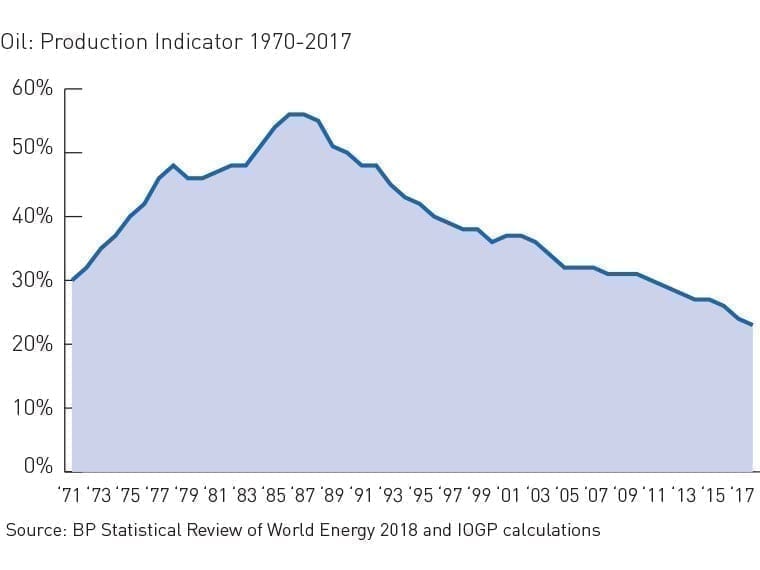

In terms of self-sufficiency, the most dramatic decline was in Australia. At the turn of the century, Australia, with a Production Indicator of 90%, was able to meet almost all of its oil demand through indigenous production. In 2017, its Production Indicator was 32%, meaning that it must import more than two thirds of its oil.

In volume terms, however, China – despite its status as a production leader – is obliged to import more oil than any of its neighbours. In 2017, China required 9.4 million barrels of foreign oil per day to meet its growing local demand. This contrasts with 20 years ago, when China imported only 1 million barrels of oil per day. In other words, on average, every two and a half years China has needed to import an additional 1 million barrels daily.

Regional demand for oil at its highest ever

Asia Pacific consumes 35% of the world’s oil, getting through 34.6 million barrels per day. This consumption has risen by a third over the past decade.

China is the region’s biggest consumer. Its more than 13-million-barrels-per-day requirement is 38% of Asia Pacific’s total demand. Second among regional consumers is India, where rising prosperity and industrialization account for 14% of Asia Pacific’s total oil demand. Japan is the region’s third largest consumer at 12%, followed by South Korea, which requires 8% of the region’s total oil consumption. With the exception of Japan, demand throughout Asia Pacific in 2017 was at or above record level.

What remains and where

Asia Pacific holds 3% of the world’s proven oil reserves. The proven reserves of the region stand at 48 billion barrels, hardly changed in the last decade following continuous investments. Half of Asia Pacific’s reserves are in China.

The future for oil in Asia Pacific: rebounding to meet growing demand

The upstream oil industry in the Asia Pacific region is struggling out of its slump; having bottomed out, it is now rebounding. From the perspective of demand side, as driven by the economic growth in Asia Pacific emerging economies and OECD countries like China and India, the energy demand in the Asia Pacific region will be maintained in a steady and sustained growth in the next two years. This will encourage investment.

From the supply side, major oil producers like China, India, Indonesia and other countries reduced their upstream investment during the recent period of lower oil prices. Currently, exploration and producing companies are keeping a close watch on the oil price trends and exploration costs. Although the development pace of new projects will not accelerate sharply, a gradual increase in E&P investment and expenditures is likely in the coming years.

Xie Yuhong, Executive Vice President, CNOOC limited