Slight production rise helps meet record gas demand

Asia Pacific prosperity still depends on gas imports

- Production: Hitting an all-time high

- Demand: China’s gas demand tripled

Production increases lag behind growing demand

the region is increasingly reliant on imports to

fuel its growing population and economy.

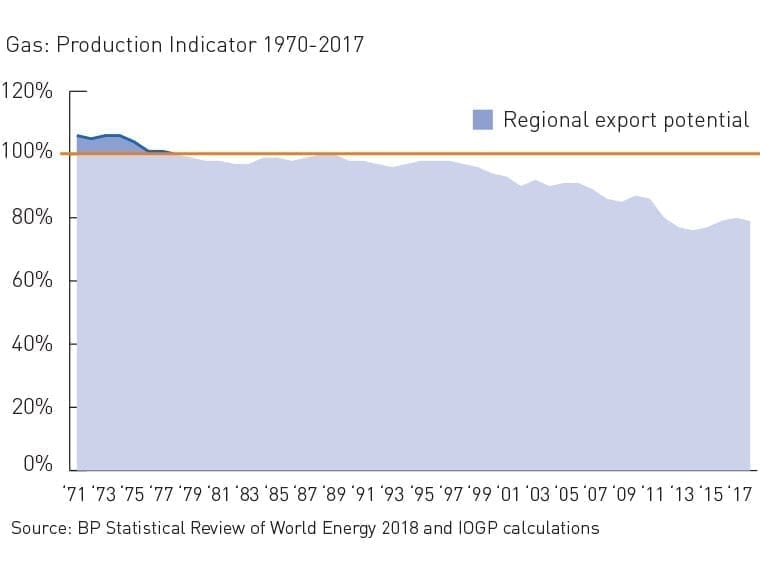

Since 2011, Asia Pacific’s Gas Production Indicator has fluctuated only slightly within a 76% – 80% range. A decade ago, it stood at 86% and was 92% in 2002.

Shortfall notwithstanding, Asia Pacific is actually producing more gas than ever before. Production in 2017 was more than 600 billion cubic metres, an increase of about 200 billion cubic metres during the course of a decade.

As in previous years, the biggest regional gas producer was China, with 149 cubic billion metres, up 80 billion since a decade ago. China had been self-sufficient in gas until 2005, when its economic expansion created greater demand than indigenous production could supply. Most recently, in 2017, China had to import 90 billion cubic metres of gas to meet its own demand.

Australia was Asia Pacific’s second largest gas producer in 2017. Its output was 114 billion cubic metres, a 61% increase compared to a decade before and 19% of the region’s total. This gave Australia an export potential – primarily to Asia – of 72 billion cubic metres, more than three times the volume it could export in 2011.

Third-ranking Malaysia produced 78 billion cubic metres, a 13% share of the region’s gas. This gives Malaysia the ability to export about 35 billion cubic metres per year.

Fourth-ranking Indonesia saw its export potential drop to below 30 billion cubic metres for the first time since 1991.

Gas demand up 67% in a decade

In 2017, Asia Pacific recorded its highest ever demand for gas: 770 billion cubic metres. The largest demand by far came from China, which accounted for 31% of the total. Japan’s 117 billion cubic feet was 15% of the total.

The rest of the region’s demand was fairly evenly split among India, Thailand, South Korea, Pakistan, Malaysia, Indonesia and Australia – all with shares of between 5%-7% of total demand and annual volumes ranging between 40-50 billion cubic metres.

To meet demand, Asia Pacific imported a total of 160 billion cubic metres of gas during 2017. Big importers are Japan, China and South Korea.

What remains and where

Asia Pacific holds 10% of the world’s proven gas reserves, with China holding the lion’s share of 28% of the regional total.

Australia follows with 19% and Indonesia and Malaysia have 15% and 14% respectively.

Meeting Asia’s growing energy demand

As the leading international oil and gas company in the Asia-Pacific region, Chevron provides energy for millions of people, creates local economic opportunity and contributes to the energy security of the region.

Today, we’re the top oil and natural gas producer in Thailand. We are also the top natural gas resource holder in Australia where we’ve developed two legacy assets, Gorgon and Wheatstone. Gorgon is one of the world’s biggest natural gas projects and the largest single-resource development in Australia’s history, and Wheatstone is the country’s first third-party natural gas hub. These projects combined injected more than US$45 billion in local content into the Australian economy during their construction and with both now online, they represent a new source of liquefied natural gas for Asia-Pacific customers and domestic gas for Western Australia for decades to come.

Chevron has exploration and production operations in eight nations across the Asia-Pacific region. We’re fuelling the future by exploring for new oil and gas reserves, developing resources and applying technology to boost production from existing fields to bring much needed new energy supplies to the region.

Steve Green, President of Chevron Asia Pacific Exploration and Production, Chevron