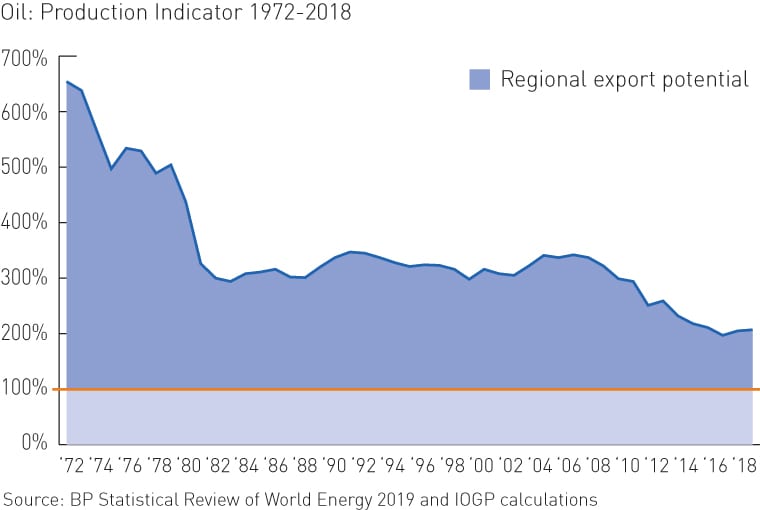

Rising domestic demand has an impact on export potential

Africa’s oil export potential has dropped by more than 40% in a decade

- Production: Has the downward trend been reversed?

- Demand: Demand in Africa is on a long-term upward trend

- While Africa can still export more than half of its production, its export potential has dropped by 40% over the past 10 years

A decade’s decline in oil self-sufficiency

In 2018, Africa’s oil production of just over 8 million barrels of oil per day remained static. More significantly, it was down 2 million barrels per day since 2008.

This, coupled with domestic demand that continues to rise, puts Africa’s latest oil Production Indicator at 207%, compared to 332% a decade before. Consequently, the region can export little more than half of its production. A decade ago, the region’s oil export potential was more than two thirds of its production.

In fact, 2008 was the year that Africa reached its highest production of oil so far.

Then, as in 2018, the biggest producer was Nigeria, accounting for 25% of the region’s oil output. Nigeria’s oil production remains stable at about 2 million barrels per day, only slightly lower than the 2.2 million barrels per day a decade earlier.

After Nigeria, the two biggest regional producers are Angola and Algeria, each of which accounts for about 20% of Africa’s oil output.

Angola’s production has dropped 18% in a decade to 1.5 million barrels per day in 2018. This is of some concern in a country so reliant on oil for its export revenues and tax base. A new comprehensive licensing round, which aims to auction 55 blocks by 2023, could improve the situation.

Algeria’s production declined by more than 20% since 2008. Production in 2018 was 1.5 million barrels.

Will declining export trend be reversed?

Among other producers: Libya had 12% of African production in 2018, down from 21% in 2008 and more than 50% in the early 1970s. However, Libya’s 2018 output of

1 million barrels per day is more than twice the production in the period from 2014-2016. Egypt has retained its share of 7-9% of African production throughout the decade.

Indigenous demand steadily rising

Between 1975 and 2018, demand for oil in Africa almost quadrupled from 1 million barrels a day to just under 4 million barrels per day – indicative of the continent’s economic growth and rising standards of living. The strongest demand comes from Egypt, which in 2018 consumed 0.76 million barrels per day. South Africa was in second place with 0.53 million barrels per day.

Moreover, demand growth is accelerating. It took 17 years between 1975 and 1992 for African demand to rise to 2 million barrels per day. It took 15 years to reach 3 million barrels per day and only 11 years to reach 4 million barrels per day.

What remains and where

The continent holds 7.2% of the world’s oil reserves, with 125 billion barrels still untapped. The largest proven reserves are in Libya, which has over 48 billion barrels. Nigeria comes second with 38 billion barrels.

Opportunities and challenges in Africa

With global oil consumption widely forecast to grow in the long-term, our strategy continues to be Africa’s leading independent oil producer. Tullow has exploration assets in a number of locations, but our production remains focused in Africa. In terms of reserves-to-production ratios, Africa is behind only the Middle East and South/Central America. When you combine this with our successful track-record on the continent, and the strong relationships that we have spent many years developing, we see Africa as an ideal place to grow our company.

In Ghana, our flagship Jubilee and TEN fields continue to deliver substantial value, in terms of both reserves and production growth. Our Non-Operated assets in Gabon, Equatorial Guinea and Côte d’Ivoire add portfolio diversification in more mature fields and continue to provide stable cash flows. West Africa therefore remains a highly attractive investment proposition for Tullow.

Our ongoing developments in East Africa have not progressed as quickly as we had initially hoped, with regulatory uncertainty continuing to be a significant challenge. We are optimistic, however, that good progress has been made recently. In Uganda, we are confident that the environmental and technical challenges can be managed, but the uncertainty around certain tax issues remains a sticking point. In Kenya, our Early Oil Pilot Scheme is expecting to deliver the first ever lifting of East African crude in Q3 2019. This will be a significant milestone both for Tullow and for the people of Kenya.

The primary barriers to our growth in Africa remain unchanged. Difficult license terms, complex tax regimes, and the length of time it takes to reduce commercial uncertainty and take decisions will continue to restrain progress. However, we are confident that our continued commitment to deliver responsible and sustainable value to the countries in which we operate will be the key differentiator in delivering value to our stakeholders and host countries.

Katherine Harvey, Senior Geoscientist – Exploration Advisor, Tullow Oil

John Power, Senior Commercial Advisor, Tullow Oil